Borrowing costs were cheaper this week, as mortgage rates continued inching down. “The U.S. economy remains on solid ground, inflation is contained, and the threat of higher short-term rates is fading from view, which has allowed mortgage rates to drift down to their lowest level in 10 months,” says Sam Khater, Freddie Mac’s chief economist. “This is great news for consumers who will be looking for homes during the upcoming spring homebuying season. Mortgage rates are essentially similar to a year ago, but today’s buyers have a larger selection of homes and more consumer bargaining power than they did the last few years.”

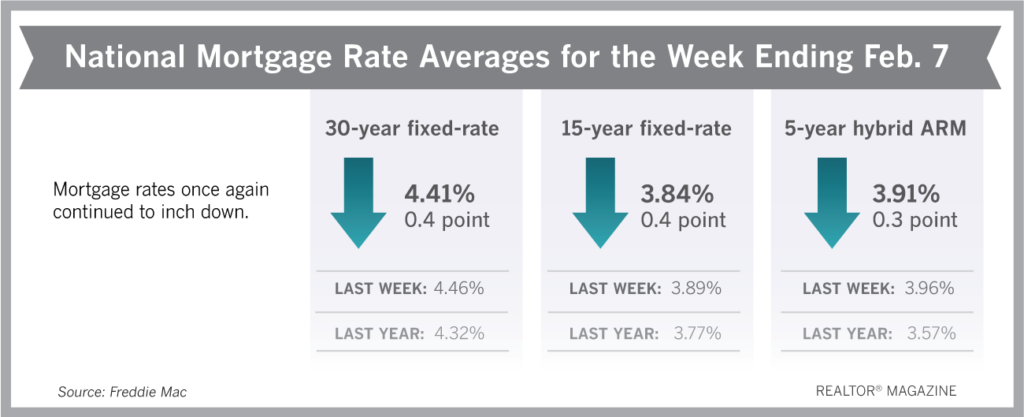

Freddie Mac reports the following averages with mortgage rates for the week ending Feb.7:

- 30-year fixed-rate mortgages: averaged 4.41 percent, with an average 0.4 point, dropping from last week’s 4.46 percent average. Last year at this time, 30-year rates averaged 4.32 percent.

- 15-year fixed-rate mortgages: averaged 3.84 percent, with an average 0.4 point, dropping from last week’s 3.89 percent average. A year ago, 15-year rates averaged 3.77 percent.

- 5-year hybrid adjustable-rate mortgages: averaged 3.91 percent, with an average 0.3 point, falling from last week’s 3.96 percent average. A year ago, 5-year ARMs averaged 3.57 percent.

Source: “Mortgage Rates Drop,” Freddie Mac (Feb. 7, 2019)