Following four weeks of rate increases, fixed-rate mortgages posted a drop this week. Rates remain well below their averages from a year ago, and Freddie Mac predicts that will be a boon to home sales over the next couple of months. This comes after the Federal Reserve voted Wednesday not to increase its benchmark rate.

“Slightly weaker inflation and labor economic data caused mortgage rates to dip this week,” says Sam Khater, Freddie Mac’s chief economist. “Moving into summer, we expect rates to be about a quarter to half a percentage point lower than where they were last year, which is good news for the housing market. These lower rates combined with solid economic growth, low inflation, and rebounding customer confidence should provide a solid foundation for home sales to continue to improve over the next couple of months.”

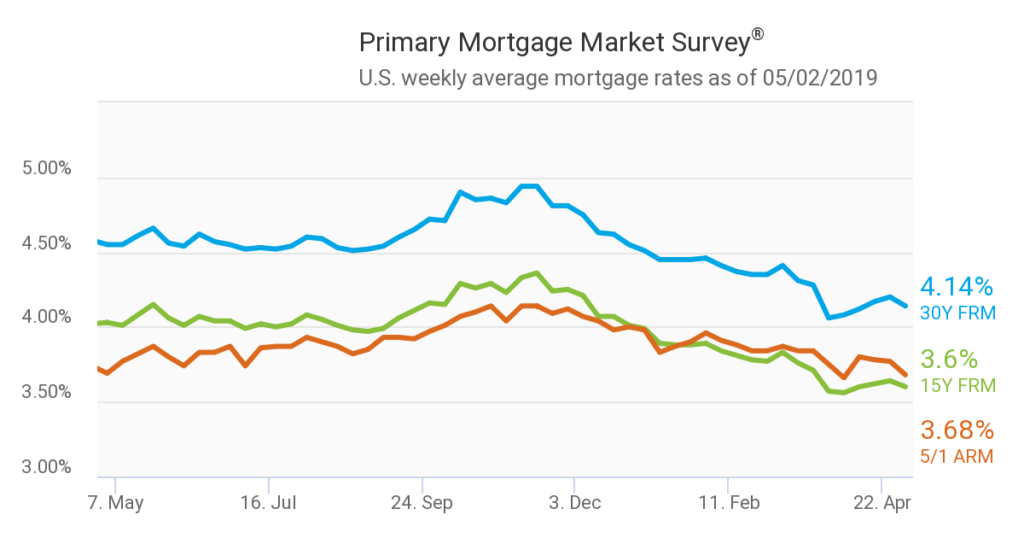

Freddie Mac reports the following national averages with mortgage rates for the week ending May 2:

- 30-year fixed-rate mortgages: averaged 4.14%, with an average 0.5 point, falling from last week’s 4.20% percent average. Last year at this time, 30-year rates averaged 4.55%.

- 15-year fixed-rate mortgages: averaged 3.60%, with an average 0.4 point, dropping from last week’s 3.64% average. A year ago, 15-year rates averaged 4.03%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.68%, with an average 0.4 point, falling from last week’s 3.77% average. A year ago, 5-year ARMs averaged 3.69%.

Source: Freddie Mac