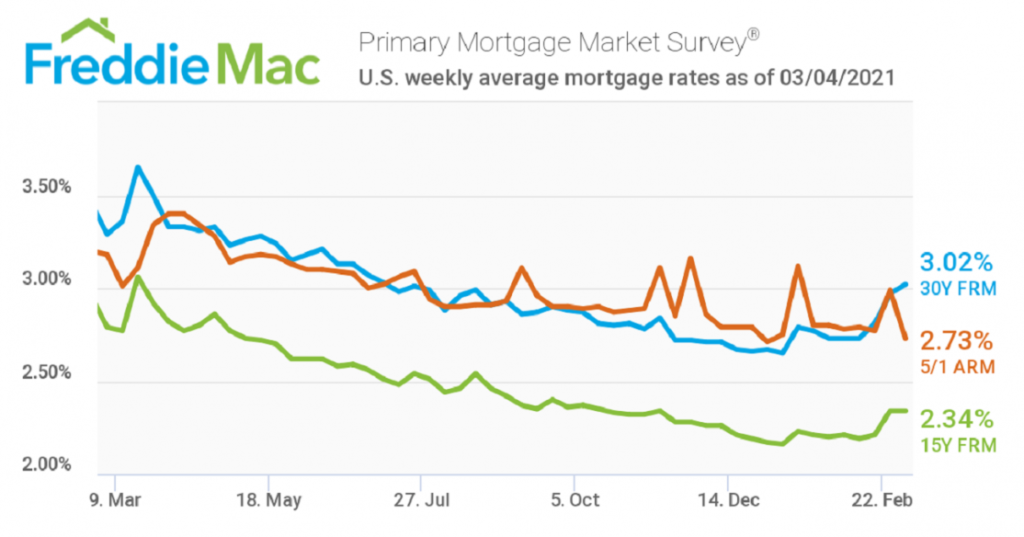

Rates have risen by more than 30 basis points since January, and the impact on purchase demand has been noticeable, Freddie Mac says.

Home buyers may not be happy: The 30-year fixed-rate mortgage topped the 3% threshold, averaging 3.02% this week, Freddie Mac reports. Despite the uptick, economists note that mortgage rates remain near historical lows.

Since reaching an all-time low in January, mortgage rates have risen by more than 30 basis points, “and the impact on purchase demand has been noticeable,” says Sam Khater, Freddie Mac’s chief economist. “While purchase activity remains high, it has cooled off over the last few weeks and is currently on par with early March, prior to the pandemic.”

Still, Khater predicts that the rise in mortgage rates over the next couple of months will likely be more muted in comparison to the last few weeks. The National Association of REALTORS® agrees, forecasting the 30-year fixed-rate mortgage to average 3% for the first half of this year.

Job gains also may help lift buyer demand regardless of mortgage rate movement. The Commerce Department reported Friday that the country added 379,000 jobs in February, which could counterbalance rising mortgage rates, says NAR Chief Economist Lawrence Yun. “The [real estate] market will experience countervailing forces of the higher push from more jobs but also the pullback of higher mortgage rates,” Yun says. “We will have to wait to see which force will be stronger. Back in 2018, the economy roared with 2.3 million job creations, but home sales modestly declined because mortgage rates rose from 4% at the beginning of the year to 4.6% by the year’s end. This time, rate increases will be occurring but will be well below 4%.”

Freddie Mac reports the following national averages with mortgage rates for the week ending March 4:

- 30-year fixed-rate mortgages: averaged 3.02%, with an average 0.6 point, increasing from last week’s 2.97% average. Last year at this time, 30-year rates averaged 3.29%.

- 15-year fixed-rate mortgages: averaged 2.34%, with an average 0.7 point, unchanged from last week. A year ago, 15-year rates averaged 2.79%.

- 5-year hybrid adjustable-rate mortgages: averaged 2.73%, with an average 0.3 point, falling from last week’s 2.99% average. A year ago, 5-year ARMs averaged 3.18%.

Freddie Mac reports commitment rates along with average points to better reflect the total cost of obtaining a mortgage.

Source: Freddie Macand “Instant Reaction: Mortgage Rates, March 4, 2021,” National Association of REALTORS® Economists’ Outlook blog (March 4, 2021)