Record low rates are likely to stick around for a while, NAR says.

Mortgage rates inched up slightly this week but still remained near historical lows. The 30-year fixed-rate mortgage averaged 2.96% this week, up from last week’s record low of 2.88%, Freddie Mac reports.

“Home buyer demand remains strong, especially for those in search of an entry-level home, where the improvement in affordability via lower mortgage rates has a material impact,” says Sam Khater, Freddie Mac’s chief economist. “Even with this week’s uptick, very low rates are providing a significant boost to the housing market that continues to hold up well during this time of uncertainty.”

The National Association of REALTORS® predicts that mortgage rates should continue to remain low and even drop as monetary policy keeps the benchmark Treasury yields under 1%.

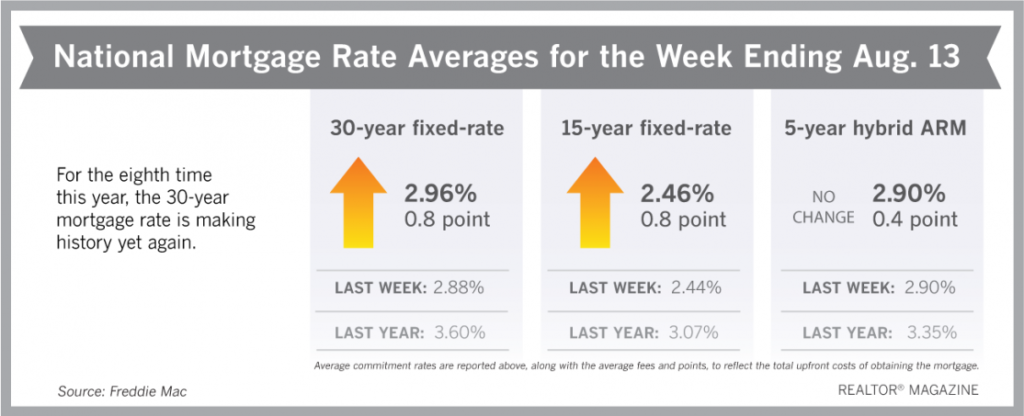

Freddie Mac reports the following national averages with mortgage rates for the week ending Aug. 13:

- 30-year fixed-rate mortgages: averaged 2.96%, with an average 0.8 point, rising from last week’s 2.88% average. Last year at this time, 30-year rates averaged 3.60%.

- 15-year fixed-rate mortgages: averaged 2.46%, with an average 0.8 point, rising from last week’s 2.44% average. A year ago, 15-year rates averaged 3.07%.

- 5-year hybrid adjustable-rate mortgages: averaged 2.90%, with an average 0.4 point, unchanged from last week. A year ago, 5-year ARMs averaged 3.35%.

Freddie Mac reports average commitment rates along with average fees and points to reflect the total upfront cost of obtaining the mortgage.

Source: Freddie Mac