“It’s Groundhog Day in the mortgage market,” says one analyst, as rates continue to remain near historic lows.

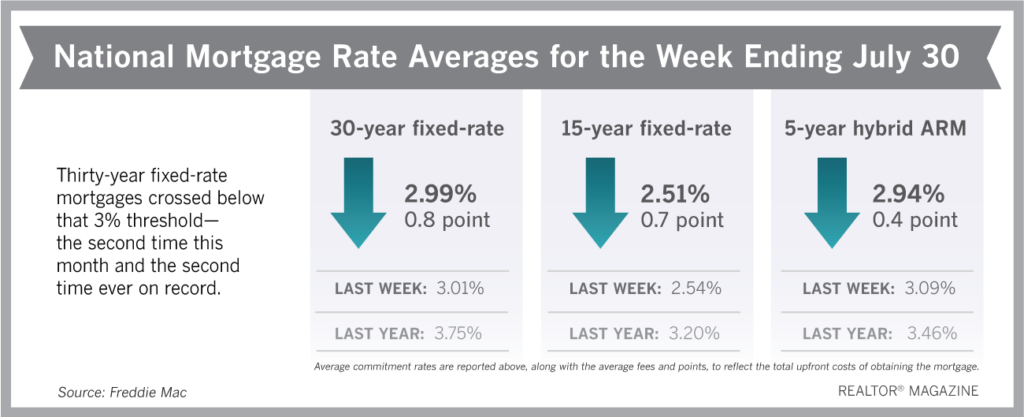

Thirty-year fixed-rate mortgages crossed below the 3% threshold—not only the second time this month but also the second time on record, Freddie Mac reports.

“It’s Groundhog Day in the mortgage market as rates continue to remain near historic lows, driving purchase demand over 20 percent above a year ago,” says Sam Khater, Freddie Mac’s chief economist. “Real estate is one of the bright spots in the economy, with strong demand and modest slowdown in home prices heading into late summer. Home sales should remain strong the next few months into the early fall.”

Lawrence Yun, chief economist of the National Association of REALTORS®, predicts that mortgage rates are likely to fall further over the next few weeks since the 10-year Treasury yields—which rates follow—have retreated over the past few weeks. “The housing market is hot because of lower mortgage rates,” Yun says.

Freddie Mac reports the following national averages with mortgage rates for the week ending July 30:

- 30-year fixed-rate mortgages: averaged 2.99%, with an average 0.8 point, falling slightly from 3.01% average. The lowest average on record is 2.98%, which occurred in mid-July. Last year at this time, 30-year rates averaged 3.75%.

- 15-year fixed-rate mortgages: averaged 2.51%, with an average 0.7 point, dropping from last week’s 2.54% average. A year ago, 15-year rates averaged 320%.

- 5-year hybrid adjustable-rate mortgages: averaged 2.94%, with an average 0.4 point, dropping from last week’s 3.09% average. A year ago, 5-year ARMs averaged 3.46%.

Freddie Mac reports average commitment rates along with average fees and points to reflect the total upfront cost of obtaining the mortgage.

Source: Freddie Mac