The national moratorium on evictions set forth by the CARES Act expired last week, but mortgage forbearance for landlords was extended in June.

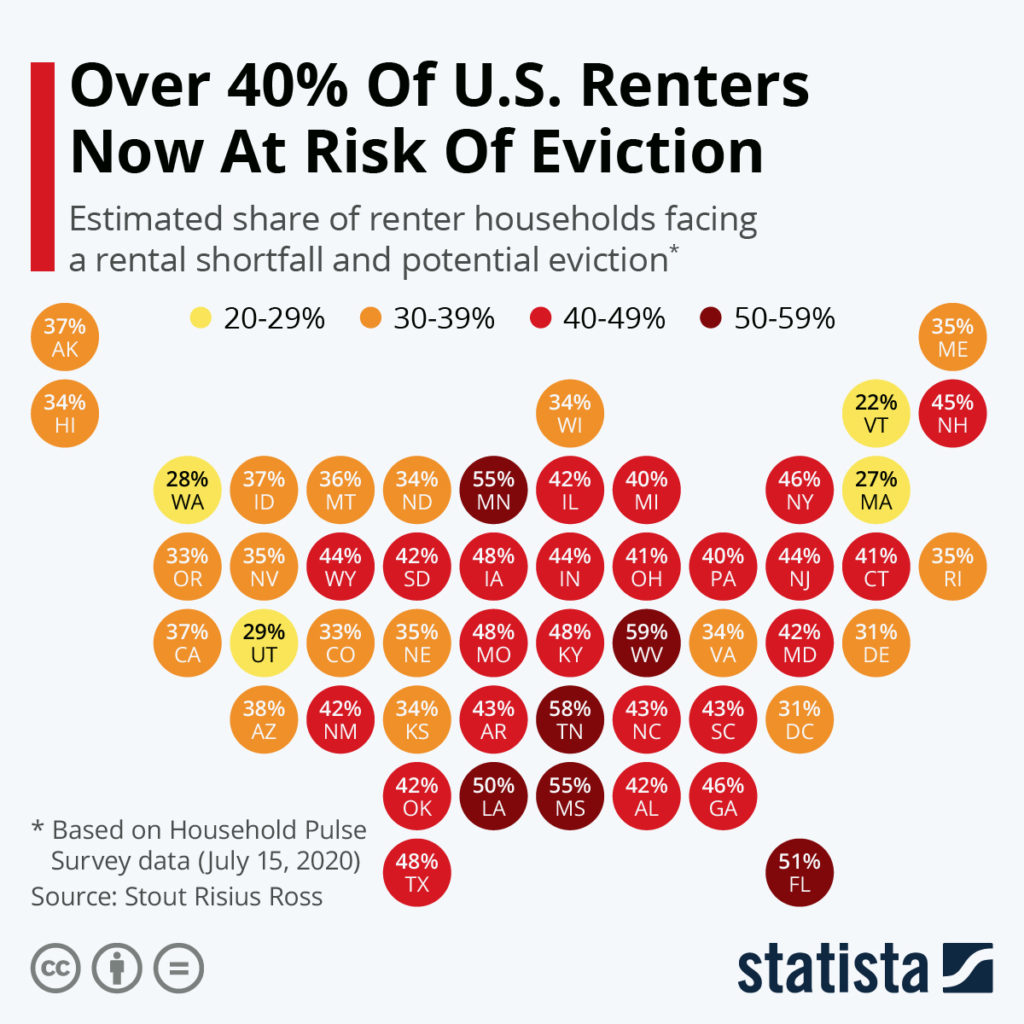

Estimated share of households facing a rental shortfall and potential eviction STATISTA

The Coronavirus Aid, Relief, and Economic Security Act moratorium on evictions expired last week. It prevented landlords from evicting tenants from homes with federally backed mortgages during the COVID-19 outbreak. But with the protections now gone and unemployment still high, many renter households could be at risk.

The National Association of REALTORS® and the Institute of Real Estate Management released a leasing conditions survey this month that shows 2% of tenants in apartment class B/C and 1% in conventionally financed apartments and single-family rentals were in the process of being evicted in the second quarter of 2020, prior to the moratorium.

There are 43 million renters in the U.S., and 18% have missed a payment and 2% have had a rent payment deferred, according to U.S. Census Household Pulse Survey.

A new analysis from Stout Risius Ross, a global advisory firm, estimates that nearly 12 million renter households could face eviction over the next four months. Some states could be harder hit than others. For example, West Virginia is estimated to have the highest share of renter households who could face eviction—close to 60%. A high percentage of renters in Tennessee, Minnesota, Mississippi, Florida, and Louisiana—50% or higher—could also receive eviction notices. Vermont renters face the lowest risk in the country, where 22% of renters there could face eviction, the report shows.

Adding to the issue, on July 31, about 25 million people across the U.S. also will stop receiving weekly $600 federal unemployment checks.

“We’re talking about millions of households who are in this deep, deep hole, who are therefore at increased risk of evictions,” Aaron Shroyer, a policy associate at the Urban Institute, told realtor.com®. “This extra $600 has been a lifeline. Without that, renters who have lost their jobs could be staring down the beginnings of mass evictions.”

In June, about 6 million renter households had at least one person out of work, according to the Urban Institute. About one in three renters did not make a full rent payment in July, according to a separate report from Apartment List. Nineteen percent of renters made no payment and 13% made a partial payment, according to the rental website.

While landlords are able to start filing eviction notices, they won’t be able to ask people to leave for another 30 days. However, not every landlord is likely to be quick to evict. “Landlords are not going to evict if they don’t think they’re going to get another tenant,” Brendan O’Flaherty, a Columbia University economics professor, told realtor.com®. His analysis places about 250,000 Americans at risk of losing their homes.

The federal government extended mortgage forbearance for landlords for an extra three months in June. Landlords are eligible as long as they don’t evict tenants affected by the coronavirus.

Lawmakers are debating whether to extend stimulus aid as more deadlines near. In the meantime, several cities and states nationwide are passing patchwork protections. For example, evictions in San Francisco are banned until Jan. 31, 2021.

Source: “Report: More Than 40% of U.S. Renter Households Are at Risk of Eviction,” Forbes.com (July 28, 2020) and “Millions of Americans Could Soon Become Homeless as Protections Expire,” realtor.com® (July 28, 2020)