The 30-year fixed-rate mortgage averaged 2.98% this week—the lowest ever.

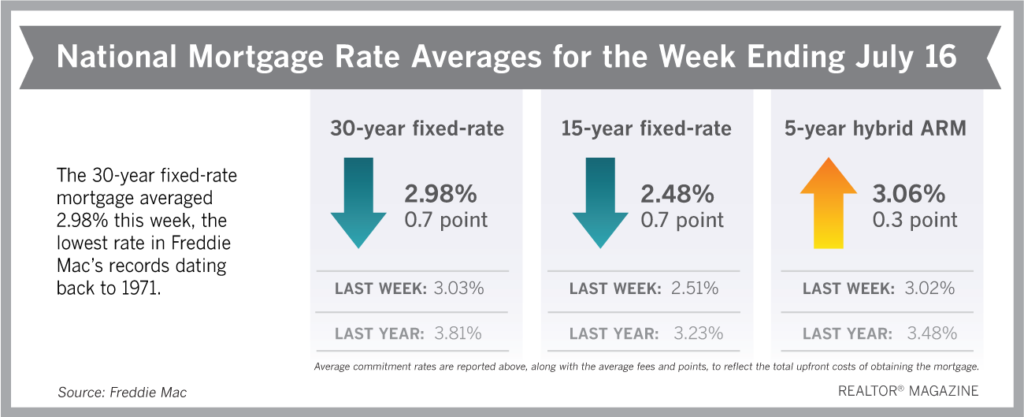

The 30-year fixed-rate mortgage averaged 2.98% this week, the lowest rate in Freddie Mac’s records dating back to 1971.

“The drop has led to increased home buyer demand and, these low rates have been capitalized into asset prices in support of the financial markets,” says Sam Khater, Freddie Mac’s chief economist. “However, the countervailing force for the economy has been the rise in new virus cases which has caused the economic recovery to stagnate, and this economic pause puts many temporary layoffs at risk of ossifying into permanent job losses.”

Freddie Mac reported the following national averages with mortgage rates for the week ending July 16:

- 30-year fixed-rate mortgages: averaged 2.98%, with an average 0.7 point, falling from a 3.03% average last week. A year ago, 30-year rates averaged 3.81%.

- 15-year fixed-rate mortgages: averaged 2.48%, with an average 0.7 point, falling from last week’s 2.51% average. A year ago, 15-year rates averaged 3.23%.

- 5-year hybrid adjustable-rate mortgages: averaged 3.06%, with an average 0.3 point, rising slightly from last week’s 3.02% average. A year ago, 5-year ARMs averaged 3.48%.

Freddie Mac reports average commitment rates along with average fees and points to reflect the total upfront cost of obtaining a mortgage.

Source: Freddie Mac